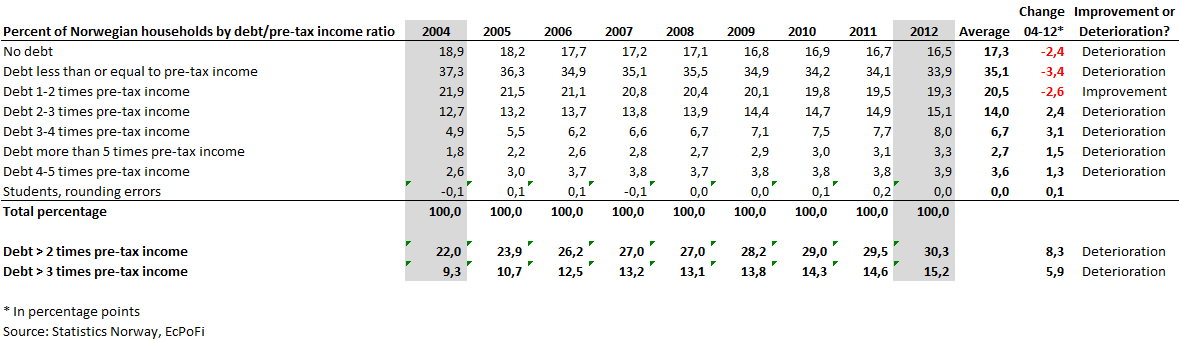

Here's an update of the table originally included in the "One of the Richest Countries on Earth has Turned its Citizens into Debt Slaves: House Prices and Debt Growth in Norway" post, now including figures for 2012:

Back in August of last year I wrote "The numbers for 2012 are yet to be published, but there is little reason to expect an improvement in the ratios as household credit grew by 5.2% in 2012". As the figures for 2012 show, the numbers got even worse in 2012. Compared to 2004, the percentage of households with debt at 2 times or more of pre-tax income has increased from 22.0% to 30.3%, an increase of 8.3 percentage points or 37.7%. On the same basis, the percentage of households with debt of 3 times or more has increased from 9.3% to 15.2%, an increase of 5.9 percentage points or 63.4%!

According to numbers released by Statistics Norway for Q3 2013 a couple of weeks ago, the debt to income ratio for Norwegian households now stands at 209.8%. To my knowledge, only a couple of countries in the world can match such a high debt level (Denmark is one). Meanwhile, the market value of the Government Pension Fund Global (Norway's "oil fund") ticked in at NOK 4.714 trillion as of the same quarter. Despite this enormous wealth, the overall tax burden (including income tax, VAT, duties etc) in Norway remains very high by any standard (yes, the new government has reduced the capital gains tax from 28% to 27% effective this year, a very small step in the right direction). Worse yet, even as the country's citizens are being, in my opinion, looted every day by the government, the bloated state bureaucracy still needs to tap into the oil fund for additional funds every year to finance the massive and ongoing mainland fiscal deficit.

During the last five years, the Labour Party led government spent an average of NOK 101.3 billion every year of Norway's oil savings to make the wheels go round, i.e. not for substantial investments or a lower overall tax burden to make Norway more productive and competitive. The budgeted deficit for 2013 was a record NOK 123 billion and the new coalition government plans to spend even more in 2014. Granted, they are planning to invest more than the previous government and to reduce taxes. But I've seen nothing yet of an ambitious plan to cut the number of government and public employees or other measures to cut public spending. Unless public spending is cut, any tax reduction will be financed by drawing down even more from the oil fund. The result is that tax payers, especially those working in the private sector, are no better off (i.e. tax cuts are financed by drawing down on the citizens savings - they are the true owners of the oil fund).

Bottom line: the citizens of Norway, perhaps the richest country on earth, are debt slaves and this will not end unless some visionary and prudent politician, one who understands and applies real economics (read: how the free market really works and how big government and fractional reserve/central banking impoverish citizens) and care about the country's long term prosperity appears out of nowhere in four years time (next election).

Back in August of last year I wrote "The numbers for 2012 are yet to be published, but there is little reason to expect an improvement in the ratios as household credit grew by 5.2% in 2012". As the figures for 2012 show, the numbers got even worse in 2012. Compared to 2004, the percentage of households with debt at 2 times or more of pre-tax income has increased from 22.0% to 30.3%, an increase of 8.3 percentage points or 37.7%. On the same basis, the percentage of households with debt of 3 times or more has increased from 9.3% to 15.2%, an increase of 5.9 percentage points or 63.4%!

According to numbers released by Statistics Norway for Q3 2013 a couple of weeks ago, the debt to income ratio for Norwegian households now stands at 209.8%. To my knowledge, only a couple of countries in the world can match such a high debt level (Denmark is one). Meanwhile, the market value of the Government Pension Fund Global (Norway's "oil fund") ticked in at NOK 4.714 trillion as of the same quarter. Despite this enormous wealth, the overall tax burden (including income tax, VAT, duties etc) in Norway remains very high by any standard (yes, the new government has reduced the capital gains tax from 28% to 27% effective this year, a very small step in the right direction). Worse yet, even as the country's citizens are being, in my opinion, looted every day by the government, the bloated state bureaucracy still needs to tap into the oil fund for additional funds every year to finance the massive and ongoing mainland fiscal deficit.

During the last five years, the Labour Party led government spent an average of NOK 101.3 billion every year of Norway's oil savings to make the wheels go round, i.e. not for substantial investments or a lower overall tax burden to make Norway more productive and competitive. The budgeted deficit for 2013 was a record NOK 123 billion and the new coalition government plans to spend even more in 2014. Granted, they are planning to invest more than the previous government and to reduce taxes. But I've seen nothing yet of an ambitious plan to cut the number of government and public employees or other measures to cut public spending. Unless public spending is cut, any tax reduction will be financed by drawing down even more from the oil fund. The result is that tax payers, especially those working in the private sector, are no better off (i.e. tax cuts are financed by drawing down on the citizens savings - they are the true owners of the oil fund).

Bottom line: the citizens of Norway, perhaps the richest country on earth, are debt slaves and this will not end unless some visionary and prudent politician, one who understands and applies real economics (read: how the free market really works and how big government and fractional reserve/central banking impoverish citizens) and care about the country's long term prosperity appears out of nowhere in four years time (next election).