The year on year money supply growth rate has been unprecedentedly stable during the last three years. However, the growth rate has picked up speed to north of 9% during the last three weeks.

This is great news for those wishing to postpone the inevitable economic correction the artificially low interest rates and vast expansion of the money supply especially since 2009 necessarily will bring about.

Those hoping for the best will find little support from savings which have fallen far short of money supply growth during especially the last four years. For businesses to produce and for the market to work as efficiently as possible, both require minimum government intervention. Perhaps most important, the market requires the accumulation of savings.

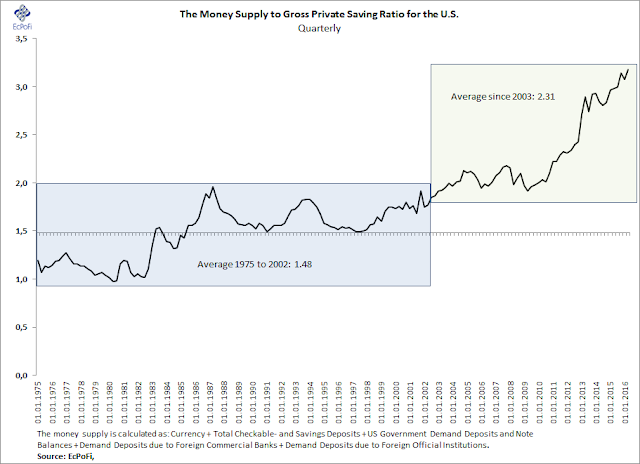

Contrary to popular opinion, an increase in the quantity of money cannot replace the role of savings. Real savings is the act of producing more than is consumed, thereby freeing up resources which can be allocated to expand future production and consumption. It should be clear that the creation of more money cannot achieve this feat. This is however the path the political "leadership" in the U.S. and most other western countries, and many others too, have pursued for decades. As an increased money supply leads to increased economic instability (as more is invested and consumed than is sustainable) and as increased savings pulls in the opposite direction, the ratio of the two is a forceful indicator of how stable or unstable an economy is.

More so than ever today based on data since 1975, the ratio signals great economic distortions in the U.S. economy. Sooner or later, these distortions will attempt to correct themselves, bringing about turmoil in the process.

This is great news for those wishing to postpone the inevitable economic correction the artificially low interest rates and vast expansion of the money supply especially since 2009 necessarily will bring about.

Those hoping for the best will find little support from savings which have fallen far short of money supply growth during especially the last four years. For businesses to produce and for the market to work as efficiently as possible, both require minimum government intervention. Perhaps most important, the market requires the accumulation of savings.

Contrary to popular opinion, an increase in the quantity of money cannot replace the role of savings. Real savings is the act of producing more than is consumed, thereby freeing up resources which can be allocated to expand future production and consumption. It should be clear that the creation of more money cannot achieve this feat. This is however the path the political "leadership" in the U.S. and most other western countries, and many others too, have pursued for decades. As an increased money supply leads to increased economic instability (as more is invested and consumed than is sustainable) and as increased savings pulls in the opposite direction, the ratio of the two is a forceful indicator of how stable or unstable an economy is.

More so than ever today based on data since 1975, the ratio signals great economic distortions in the U.S. economy. Sooner or later, these distortions will attempt to correct themselves, bringing about turmoil in the process.

No comments:

Post a Comment