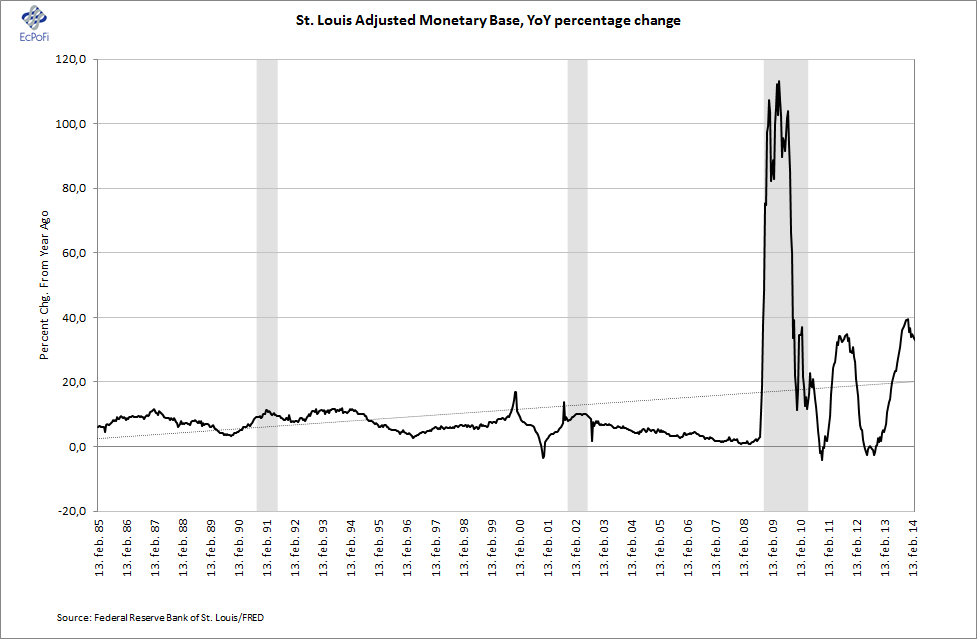

The U.S monetary base increased USD 71.5 billion during the last month according to the most recent bi-weekly monetary statistics released by the Fed. During the past 12 months the base has increased a total of USD 978.8 billion, or 33.1%. Though a significant increase, it was the lowest increase in the base in percentage terms since early September last year. It has gradually fallen since hitting 39.4% at the end of last year. This decline in the year on year (YoY) growth rate will continue going forward if the Fed proceeds as planned as it has now tapered its asset purchases by USD 30 billion a month to USD 55 billion a month starting April this year.

As I have explained on numerous occasions before, as the Fed is tapering an increased burden is put on banks to keep the growth rate in the money supply up. If they don't, the money supply growth will plummet and drag with it both the stock market and the economy. Should that look like becoming the case, the Fed will likely widen the monetary flood gates further once again. Bank Credit is now however showing some revived signs of increased growth. Having bottomed at 1.14% toward the end of 2013, the YoY growth rate has climbed to 3.02%, the highest reported eight months. This increase in bank credit has helped push up the YoY growth rate of the M2 money supply, from 4.87% in early January to the current 6.06%.

This growth in Bank Credit was driven by an increase in Loans & Leases. After bottoming at 1.86% in the early part of this year has since increased to the current YoY growth rate of 3.57%. This was the highest growth rate since early May last year.

The treasury yields were largely unchanged on two weeks ago. Compared to the same period last year, the 1-year yield is down 1 basis point while the 10-year is up 82 basis points leading to a 83 basis point widening of the spread.

As I have explained on numerous occasions before, as the Fed is tapering an increased burden is put on banks to keep the growth rate in the money supply up. If they don't, the money supply growth will plummet and drag with it both the stock market and the economy. Should that look like becoming the case, the Fed will likely widen the monetary flood gates further once again. Bank Credit is now however showing some revived signs of increased growth. Having bottomed at 1.14% toward the end of 2013, the YoY growth rate has climbed to 3.02%, the highest reported eight months. This increase in bank credit has helped push up the YoY growth rate of the M2 money supply, from 4.87% in early January to the current 6.06%.

This growth in Bank Credit was driven by an increase in Loans & Leases. After bottoming at 1.86% in the early part of this year has since increased to the current YoY growth rate of 3.57%. This was the highest growth rate since early May last year.

The treasury yields were largely unchanged on two weeks ago. Compared to the same period last year, the 1-year yield is down 1 basis point while the 10-year is up 82 basis points leading to a 83 basis point widening of the spread.